Interac e-Transfers is a payment method that is highly secure and fast which allows you to transfer funds from your Canadian bank account to a merchant or casino without revealing sensitive financial information.

Many Canadians who shop online are already familiar with using Interac, but some may not know that it can be used to fund gaming accounts as well as make other purchases over the internet.

Interac is now the most popular deposit and withdrawal method at online casinos due to it’s numerous advantages which include:

- Speed – In comparison to other payment methods, Interac is fast for BOTH deposits and withdrawals. This is demonstrated in various tests as shown later in this article

- Bypassing KYC/ID verification processes – By utilizing Interac, some (although not all) casinos will allow you to withdraw without the hassle of uploading ID

- Ease of Use – Since Interac is tied to your Canadian bank account, there’s no need for any third party apps and transactions will be processed without any issues as opposed to doing direct bank transfers which may get declined.

- No Fees – There are zero processing fees at online casinos when using Interac

Later in this article we will give our recommended online casinos which accept Interac which you can jump straight to here. These are all tested for speed, ease of use and fairness.

Alternatively, we also recommend using crypto to play at an online casino since it is just as fast, if not faster than Interac. You see can see our list of recommended crypto casinos here. Any other payment method isn’t as convenient which can be seen here.

Best Interac Casinos for 2024

Top 10 Interac Casinos in Detail

| Casino | Games | Identity Verification | Time to Withdraw with Interac | Last Tested |

|---|---|---|---|---|

| SIA | 981 | Required | ~12 hours | 30 November, 2023 |

| LeoVegas | 5095 | Not Required | ~48 hours | 6 January, 2024 |

| PlayOJO | 6144 | Required | ~48 hours | 27 February 2024 |

| Royal Panda | 4792 | Not Required | ~48 hours | 6 January 2024 |

| Wildz | 2880 | Not Required | Less than 12 hours (via eCashout) | 9 December, 2023 |

| Rooster.bet | 6463 | Not Required | ~48 hours | 20 November, 2023 |

| 888 | 4792 | Required | ~48 hours | 3 March 2024 |

| 777 Casino | 5590 | Not Required | ~48 hours | 13 December, 2023 |

| Dreamz | 5371 | Required | ~8 hours | 29 January 2024 |

| King Billy Casino | 5808 | Required | ~24 hours | 30 December, 2023 |

Contrary to other comparison websites, we test online casinos regularly by actually depositing/withdrawing funds and providing video walkthroughs so you can see exactly how these casinos operate.

Our objective is to provide GENUINE and REAL reviews of online casinos so you, the consumer, have fair information provided before making any decision to gamble online.

#1 – SIA

Pros:

- Really quick deposit/withdrawal speeds when using Interac

- Established and trusted brand

- Low minimum deposit amount of $10 with Interac

Cons:

- Gaming catalogue isn’t as impressive as other casinos

- KYC documents required before processing withdrawal

Last tested – 30 November, 2023

Formely known as Sports Interaction, SIA is a well known brand who have been operating since 1997. One of the rare casinos that actually have a dedicated 24/7 phone support line, SIA takes pride in assuring its customers fairness is of the utmost importance.

Definitely the smoothest and fastest experience I have had when it comes to making deposits and withdrawals with Interac, we had to rate them #1 soley because of this. While other casinos tend to take time with approval processes and whatnot, deposits and withdrawals were instant for us (after uploading identity verification documents) and I was extremely pleased with how seamless it was playing at SIA.

Since they utilize the Payper Inc. gateway, there was no need to fiddle around with manually entering an email address to send funds to and withdrawing was automated as well. This not only makes for a faster process, but ensures you are sending funds correctly without making the possible mistake of entering in the wrong address.

In our test, it took around 12 hours to receive our winnings.

#2 – Leo Vegas

Pros:

- KYC not required

- Award winning established casino

Cons:

- Withdrawal took us a bit longer compared to other casinos

Last tested – 6 January, 2023

An established brand with a stunning history of regularly winning awards year in year out, it is of no surprise why we rate LeoVegas as one of the best Interac casino for Canadians.

In 2023 alone, they have won the award for Operator of the year from International Gaming Awards, EGR and Global Gaming Awards. They also hold licenses with MGA and Ontario iGaming and pride themselves of providing a genuine entertaining and fair gaming experience.

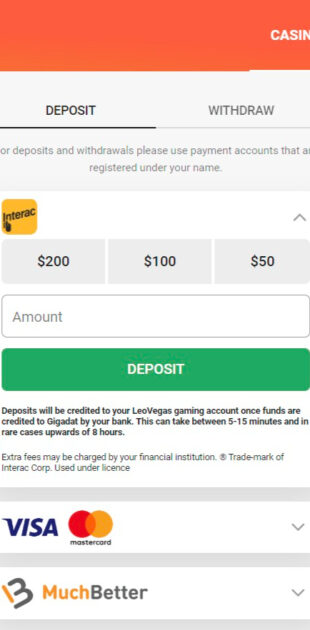

LeoVegas allows for Interac e-Transfers as well as Interac Online for deposits, making the banking experience a seamless as possible. The minimum deposit amount is $10 and the maximum is $3,000.

So what about the gaming experience at LeoVegas? With a staggering catalogue of almost 5,000 titles to choose from, LeoVegas is exceptional and also has a sports betting platform too.

The overall seamless integration of Interac coupled with the diverse gaming experience and award winning pedigree makes LeoVegas one of our top rated Interac casinos.

In our test it took about 48 hours to for a withdrawal to be processed via Interac. No KYC documents were required

#3 PlayOJO

Pros:

- Low minimum deposit of $10CAD

- Interac e-Transfer and Interac Online options available

- Award winning established casino

- Speedy customer support

Cons:

- KYC documents are required for withdrawals (ID, utility bill)

Last tested – 27 February 2024

PlayOJO is an award winning casino with recent accolades including Slots Operator and Mobile Casino Product of the year at EGR. It is of no surprise, Interac is supported here with the option to deposit via bother Interac e-Transfer of Interac Online.

Unfortunately, they do require KYC documentation to be uploaded before withdrawing, but once that process is completed, withrawals are quite fast.

In our test, it took ~48 hours for withdrawals to be processed.

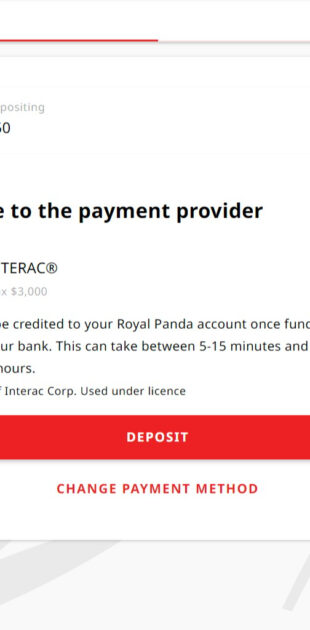

#4 – Royal Panda

Pros:

- Can deposit through both Interac e-Transfer and Interac Online

- Good variety of promotions on a regular basis

- KYC documents are not required when withdrawing via Interac

Cons:

- No dedicated app

- No phone support

Last tested – 6 January 2024

Known for it’s cute panda themed interface, Royal Panda has been an established brand in the industry operating since 2014. We want to make sure all of our recommendations are based first and foremost on trust and Royal Panda certainly fits the criteria.

Acquired by LeoVegas in 2017, Royal Panda has exceptional customer support with 24/7 dedicated live chat and an extremely diverse gaming catalogue including live dealers.

Compared to the competition, Royal Panda also has very low wage requirements (20x) for their bonuses, making them a great choice for those looking to take advantage of promotions.

When using Interac, Royal Panda has a minimum deposit amount of $10 and a maximum of $3,000.

#5 – Wildz Casino

Pros

- Very fast deposits with Interac

- Interac online and Interac e-Transfer available

- Withdrawals are very quick without having to submit KYC documents

Cons

- Administrative fee of $5 CAD is applied if your account is inactive for 12 months

- Wage requirements on bonuses are high

- Interac is not a withdrawal option

Last tested – 9 December, 2023

Why does Wildz Casino make our top 10 list? Speed, speed, speed, speed. This casino is extremely quick when it comes it depositing using Interac. When we made a deposit via BMO, the funds were in our account almost instantaneously making for a very seamless experience.

Unfortunately, Interac is not a withdrawal option, however, they have an eCashout bank transfer option which is just as fast. When we tested this casino, it took less than 12 hours to receive our withdrawal.

#6 – Rooster.bet

Pros:

- You can use Interac to fund your account in various different currencies, not just CAD

- Interac transaction can be processed via QR

- Amazing gaming catalogue

Cons:

- Very new casino, only launched in 2023 and has yet to build a reputation

- Miminum withdrawal amount using Interac is quite high at $30 CAD

- Depositing via Interac is a bit slow

Last tested – 20 November, 2023

Rooster.bet is a new kid on the block and launched in 2023 looking to make an imprint in the industry by providing a tonne of gaming and banking options. One of the first casinos I’ve ever seen allow you to do Interac transactions via Jeton utilizing QR code. This makes it a little bit simpler by simply scanning a QR code instead of potentially inputting the wrong address as with e-Transfer.

In our test, it took ~48 hours for a withdrawal to be processed.

#7 – 888 Casino

Pros:

- Award winning established casino

- Low minimum deposit of $10 with Interac

- Withdrawal process is quick

Cons:

- KYC documentation required

Last tested – 3 March, 2024

One of the most reputable casinos in the industry, 888 Casino has been operating since 1997 and have won many awards along the way. Most recently, they won the EGR operator of the year for 2022.

Always adapting with the latest trends, it is of no surprise Interac is supported at 888 Casino and is the default payment option there when making a deposit/withdrawal.

As seen in the walkthrough above, the process is extremely seamless, however, ID documentation does need to be verified first before they will release funds to your account.

In our test, it took about ~48 hours after ID verification for the withdrawal to be processed.

#8 – 777 Casino

Pros:

- Depositing is extremely quick

- Doesn’t require KYC documentation to be uploaded

- Interac online and Interac e-Transfer options available

Cons:

- Customer support is very slow to respond

- Withdrawals are not as fast as other casinos. It took us about 48 hours to receive our withdrawal.

Last tested – 13 December, 2023

If you haven’t heard of 777 Casino before, they are operated by the same company as 888 (888 Holdings group) and operate in a similar fashion.

777 Casino make the depositing and withrawal process very seamless when it comes to Interac. Offering both Interac Online (depending on your banking institution) and Interac e-Transfer for depositing, we found it to be extremely quick and funds were in our account instantly after filling in the form details.

The withdrawing process was also really nice as it auto populates the forms based off your depositing details so there’s no need to fiddle around with entering in your bank details again.

In our test, it took about ~48 hours after ID verification for the withdrawal to be processed.

#9 – Dreamz Casino

Pros:

- Really great and transparent user experience when it comes to depositing/withdrawing. No need to manually speak to customer support

- KYC process is really quick, easy and seamless to use.

- Withdrawals are incredibly quick but only after verifying ID

Cons:

- Your deposit must be wagered 3x before being able to withdraw

- KYC is required

- 3x wage requirement

Last tested – 29 January 2024

Dreamz is a great platform with a really slick and easy to use interface. I was initially going to rank them higher since withdrawing via Interac from Dreamz is extremely quick, however, the KYC process can be a bit over the top. They require a liveness check, photo id (from either passport, driving license, identity card or visa) and proof of address (from either utility bill, bank statement, tax document, insurance document).

There is also a 3x wage requirement before they allow for withdrawals. In my case, I deposited $65 CAD so I was asked to wager a minimum of $195CAD before my withdrawal request was accepted.

In our test, it took ~8 hours for withdrawals to be processed after account verification.

#10 – King Billy Casino

Pros:

- Incredibly quick deposits and withdrawals

Cons:

- Your deposit must be wagered 3x before being able to withdraw

- KYC is required before being able to withdraw

Last tested – 30 December, 2023

One of the very first casinos in Canada to offer cryptocurrency payment options, it’s no surprise they still also accept Interac since it’s more widely known. Depositing via Interac is incredibly fast and almost instantaneous. As soon as you enter the e-Transfer details for your deposit, the funds are credited to your account immediately.

They have also made the withdrawal process quite fast, however, note they do require you to provide KYC documentation which may take some time to approve.

Similar to Dreamz, they also have a 3x wage requirement before they allow for withdrawals. In my case, I deposited $65 CAD so I was asked to wager a minimum of $195CAD before my withdrawal request was accepted.

In our test, it took ~24 hours for withdrawals to be processed after account verification.

Our Ranking Process

If you’ve ever played at an online casino before, the most common complaint is whether the casino will genuinely payout in a timely manner. There are many factors as to why a casino may have delayed payments which include:

- Whether it requires a player verification process – Some online casinos typically require players to undergo a verification process before processing withdrawals. This process may involve providing identification documents to confirm the player’s identity and ensure compliance with regulatory requirements. Delays in verification can prolong payout times.

- Casino reputation – Are they an established casino or new to the market? The reputation and trustworthiness of the online casino can indirectly influence payout times. Casinos known for prompt and reliable withdrawals are more likely to prioritize timely processing for their players.

- Withdrawal method – Interac is one of the fastest ways to deposit/withdrawal. However, if you were to use for example, a normal bank transfer, the process to withdraw will be much longer of up to 5 business days in some cases or more.

So during our ranking process, we test:

- Does the casino support Interac as deposit/withdrawal method?

- Does the casino require player verification documents to be uploaded first before processing withdrawals?

- Does the casino require wage requirements before processing withdrawals?

- How long does a withdrawal via Interac actually take?

If there is a casino you would like for us to test, you can leave a message on our contact form and we would be more than happy to put them through the rigor.

Interac vs Other Payment Options

Here is a summary of how Interac compares to other payment options:

| Payment Method | Availability | Fees | Speed | ID Required for Withdrawals |

|---|---|---|---|---|

| Interac | All casinos | None | Fast on deposits and withdrawals | Sometimes |

| Cryptocurrency | Few casinos | Mining fee when depositing | Can be slow on deposits | Sometimes |

| Visa/Mastercard | All casinos | None | Fast on deposits only | Withdrawals not available |

| iDebit | Some casinos | Yes | Fast on deposits and withdrawals | Yes |

| E-Wallets | Very few casinos | Yes | Fast on deposits and withdrawals | Yes |

| Prepaid Cards | Some casinos | Yes | Fast on deposits only | Withdrawals not available |

For a complete list of payment option comparisons, visit this page for more details.

Advantages of using Interac Explained

There are several benefits in using Interac as a depositing method at online casinos.

Popularity

Interac is a well known online purchasing method for goods and services, so many Canadians will take to the method easily when it comes to depositing in a casino account.

Withdrawals

One advantage of using Interac is that it is tied directly to your bank or credit account so many casinos that accept it as a deposit method will also let you withdraw back to it. Rather than waiting up to seven working days for your winnings to appear on a credit or debit card, or paying fees for bank wires, your payout can go right to your account.

No KYC Requirements

Because Interac provides a direct channel between your bank and the casino, the annoying process of uploading documentation to verify your identity is no longer required. Note, this is not the case for ALL casinos, but there’s a lot that will forego the KYC process because you’ve used Interac.

Anti-Fraud

Multiple layers of security ensure players that their bank account or credit card numbers don’t need to be given to any online casino. While you can send money to and from your bank and Interac account, and transfer from casino to Interac, it provides another level of security.

Disadvantages of using Interac

Expiry

The recipient must complete actions to affect every transaction. If the casino somehow neglects to debit your Interac account, yet credits your gaming account, the transaction’s life-cycle will expire in 30 days. If a player doesn’t notice that they played for free it may take awhile to sort it with the merchant.

Phishing

Transaction notices are done via email. All electronic transactions are as vulnerable to phishing as the sender is. If a player doesn’t log into their account directly but responds to an email asking for passwords or other information, they could give bad actors access to their accounts.

Interac Online vs Interac e-Transfer – What’s the Difference?

At some casinos you may across the option to select etiher Interac Online or Interac e-Transfer but what’s the difference?

Interac e-Transfer: Commonly used to transfer funds to family/friends, this method enables you to make a deposit by entering an email address and is widely available at most financial institutions and credit unions.

Interac e-Transfer: Commonly used to transfer funds to family/friends, this method enables you to make a deposit by entering an email address and is widely available at most financial institutions and credit unions.

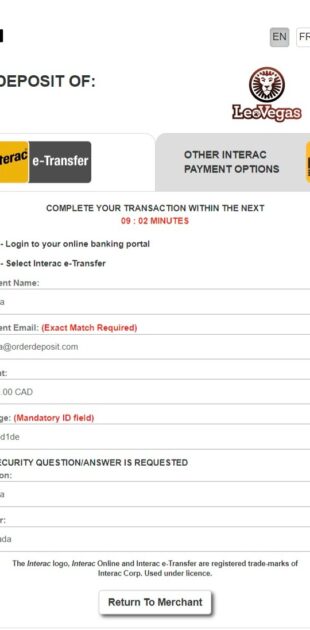

When playing at an online casino, they will provide you with a specified email address and security question/answer which you then submit from your bank account.

Interac Online: This option is more seamless in that the online casino provides a payment gateway for you to transfer funds directly from your bank account. It will step you through logging into your bank account directly and there is no need to input an email as with using Interac e-Transfer. While this process is slightly faster than using e-Transfer, the downside is that it’s not as widely available.

Interac Online: This option is more seamless in that the online casino provides a payment gateway for you to transfer funds directly from your bank account. It will step you through logging into your bank account directly and there is no need to input an email as with using Interac e-Transfer. While this process is slightly faster than using e-Transfer, the downside is that it’s not as widely available.

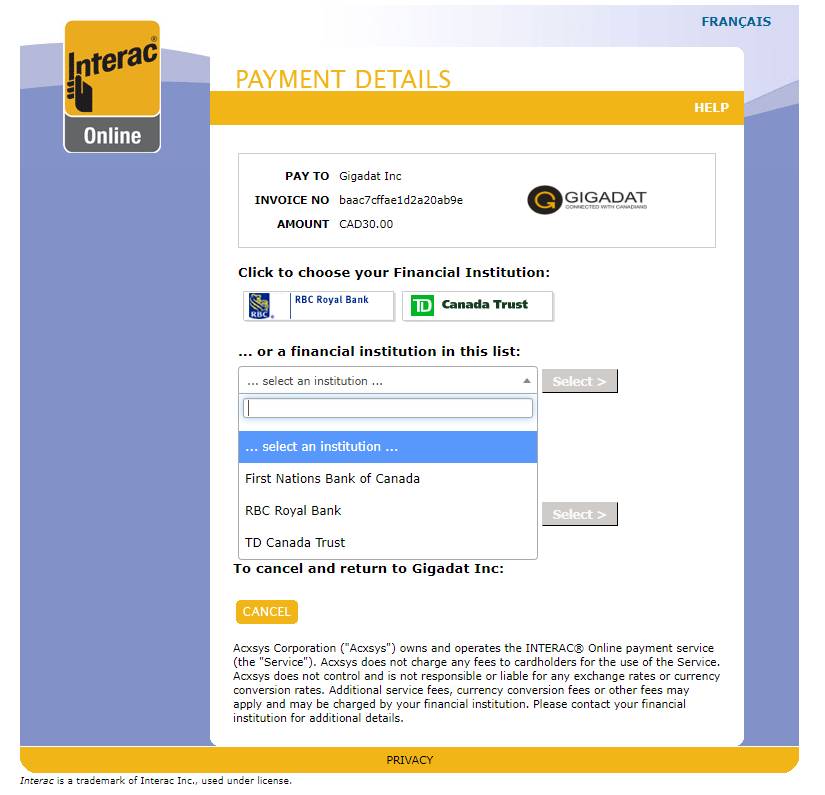

For example, at Casino Cruise, Interac Online is only available to customers of the following financial institutions: First Nations Bank of Canada, RBC Royal Bank and TD Canada Trust. It is also available to select credt unions depending on which province you are from.

How to make a deposit using Interac at an online casino:

As mentioned earlier, there are two options when using Interac, Interac Online and Interac e-Transfer. The difference is that Interac Online will allow you to transfer funds directly from your bank account using a payment gateway while Interac e-Transfer will require you to log into your bank account separately in order to perform the transfer via email. Interac Online is a slightly faster process but isn’t as widely accepted as Interac e-Transfer as you’ll see later in this guide.

Interac Online Guide

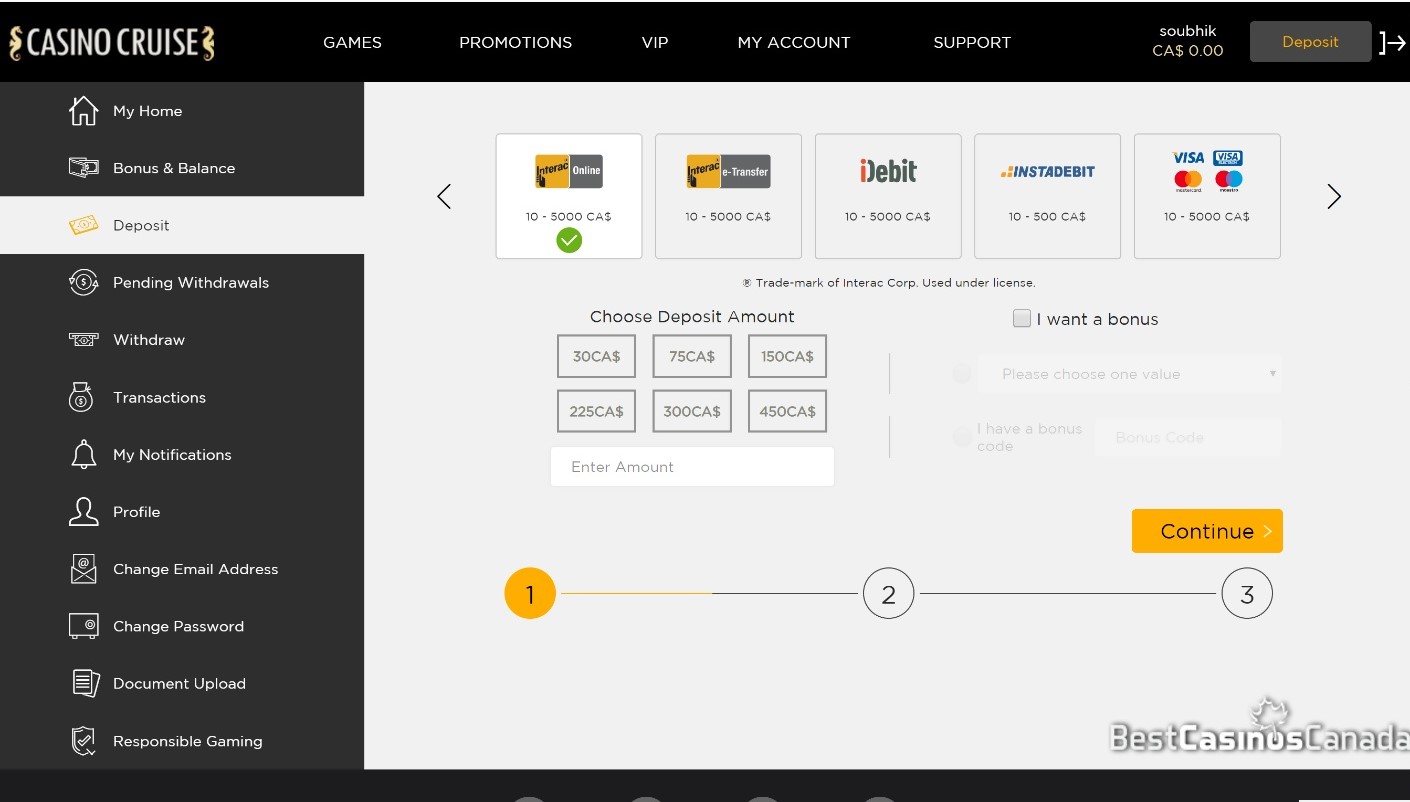

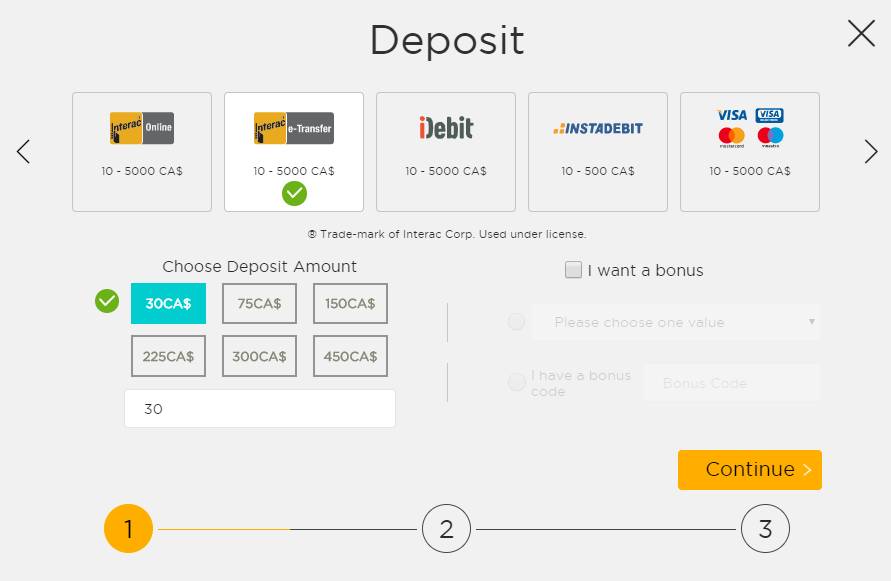

Step 1 – Selecting Interac Online

In the deposit section, first select Interac Online and choose / enter in the amount you want to deposit and follow the prompts.

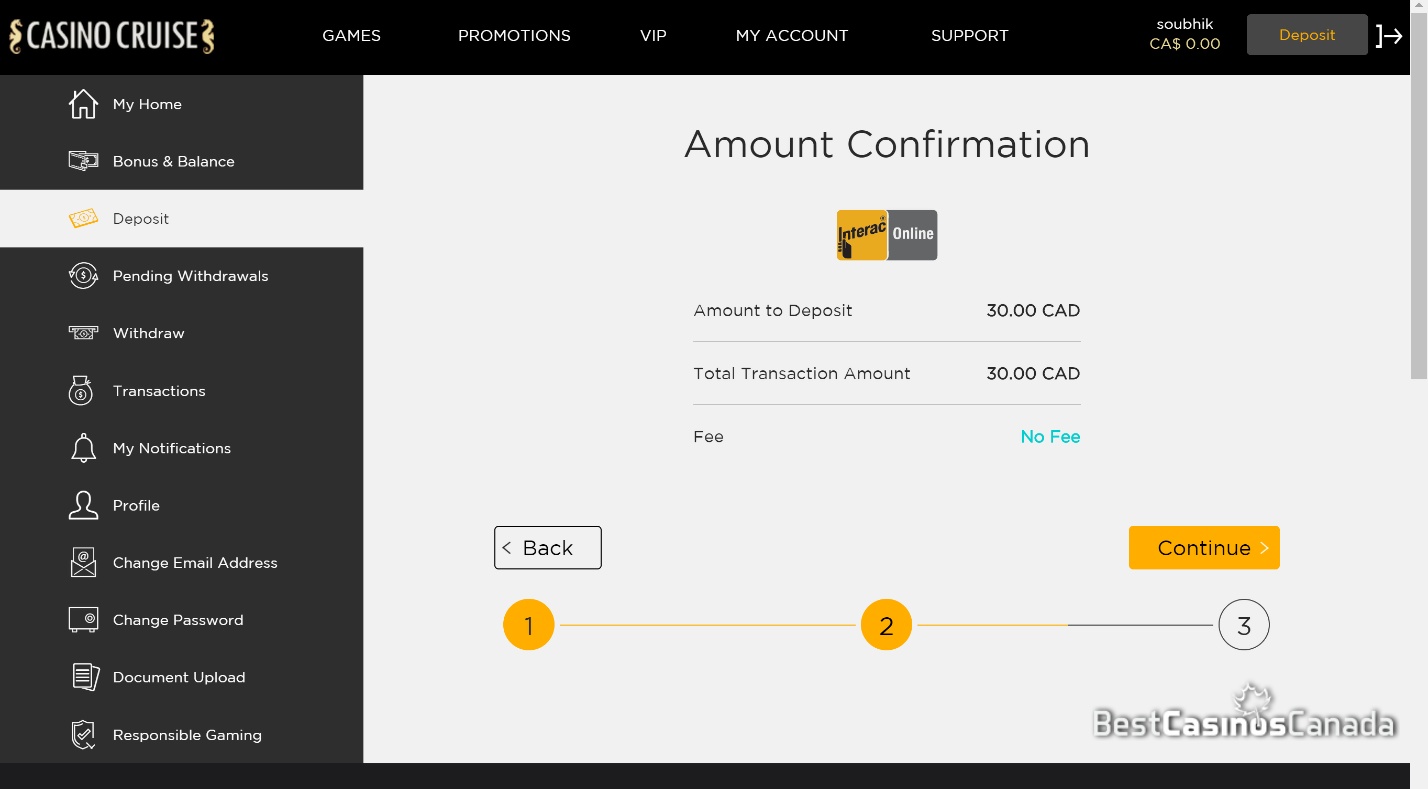

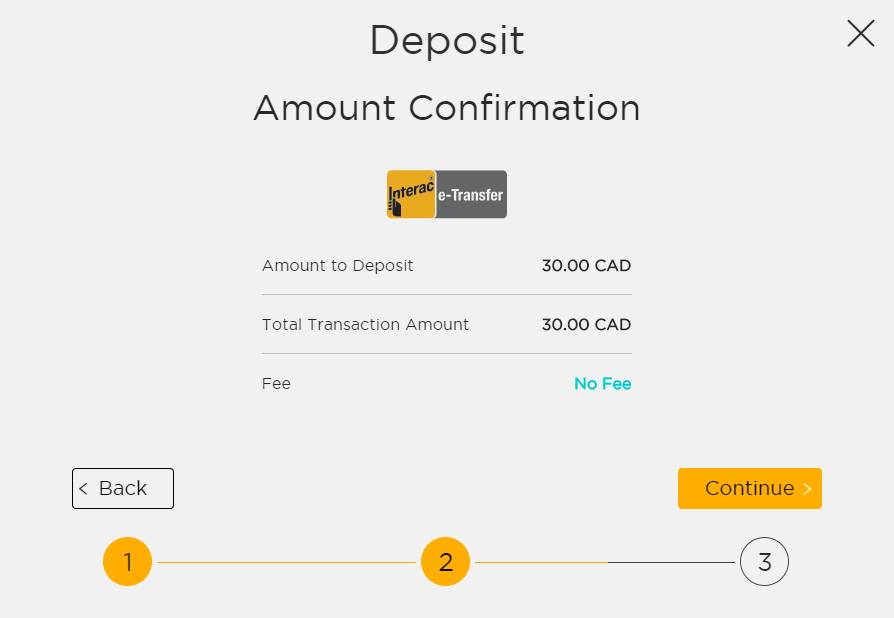

In this example, we chose to deposit $30 which we confirmed on the following screen:

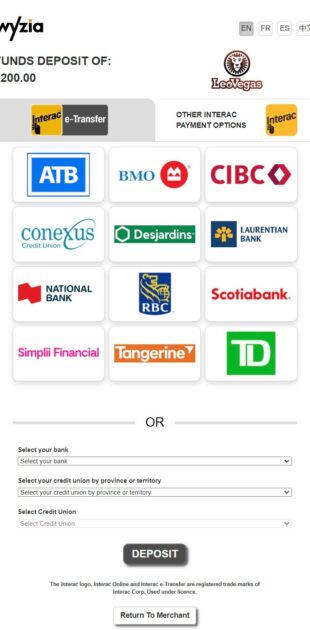

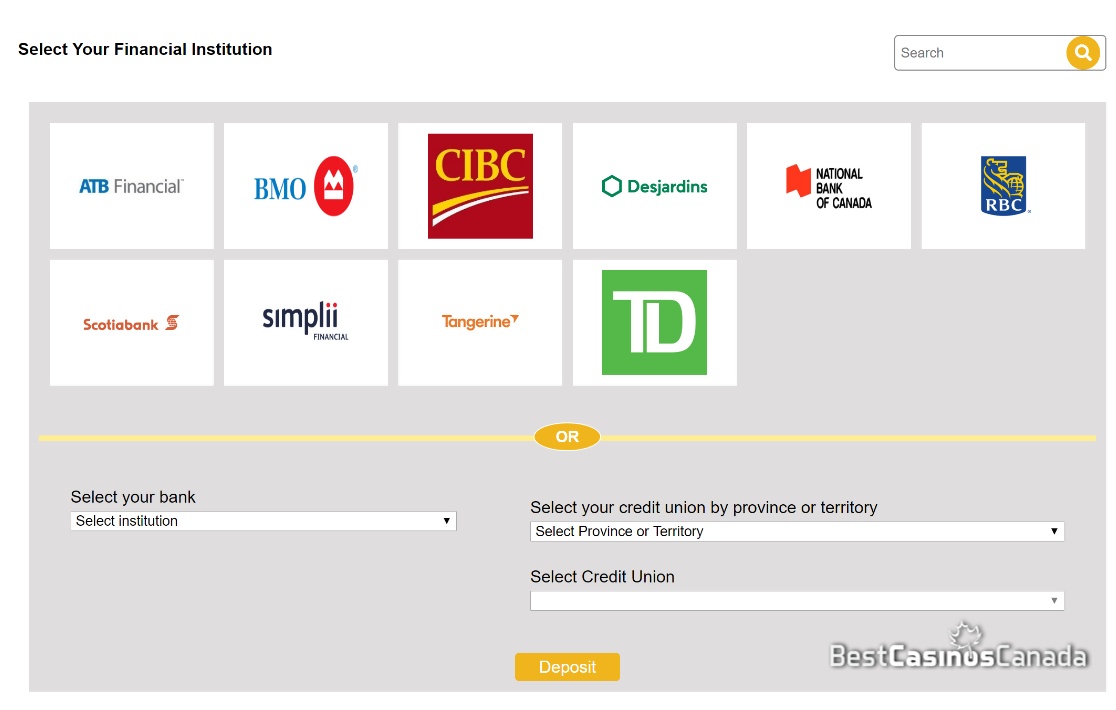

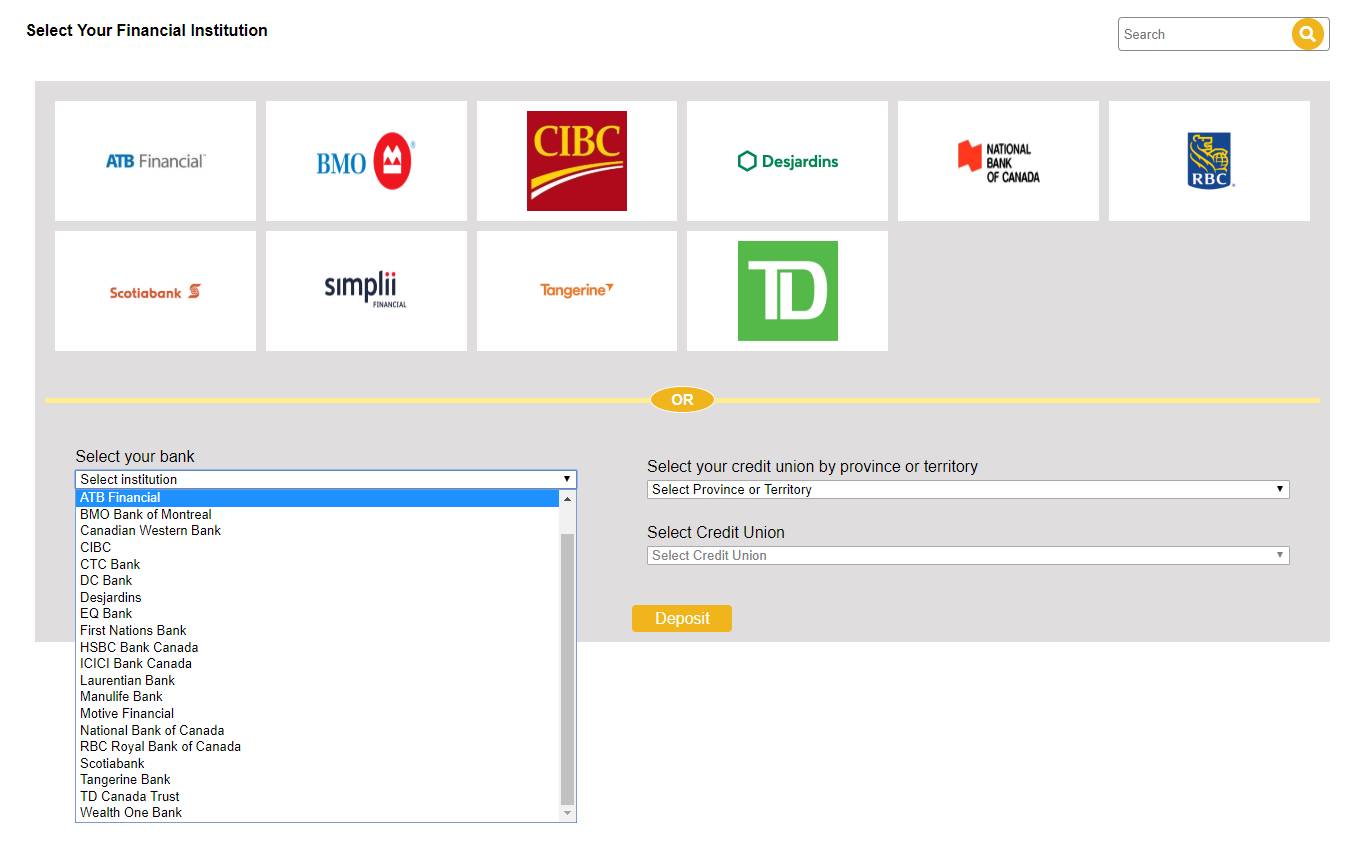

Step 2 – Select your Banking Institution

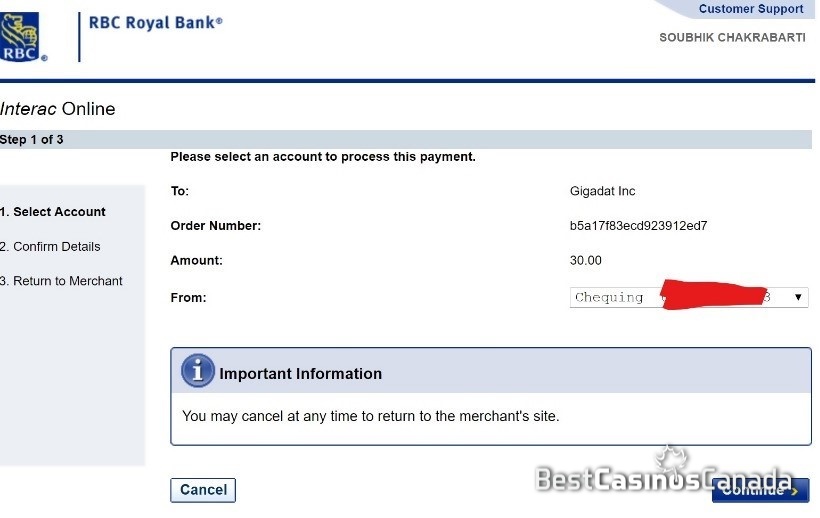

Similarly to any regular Interac Online transaction you would perform on other e-commerce sites, here you will need to select your corresponding banking institution to transfer funds from. After selecting your bank, you will then be forwarded to the payment gateway which is handled by Gigadat.

While it looks like you can select from a multitude of financial institutions/credit unions, you’ll see on the following screenshot that it’s actually not the case (only actually available to First Nations Bank of Canada, RBC Royal Bank and TD Canada Trust. We’re not sure why online casinos do this but just take note that if your bank/credit union is not available then you’ll have to click on “Cancel” and select Interac e-Transfer instead.

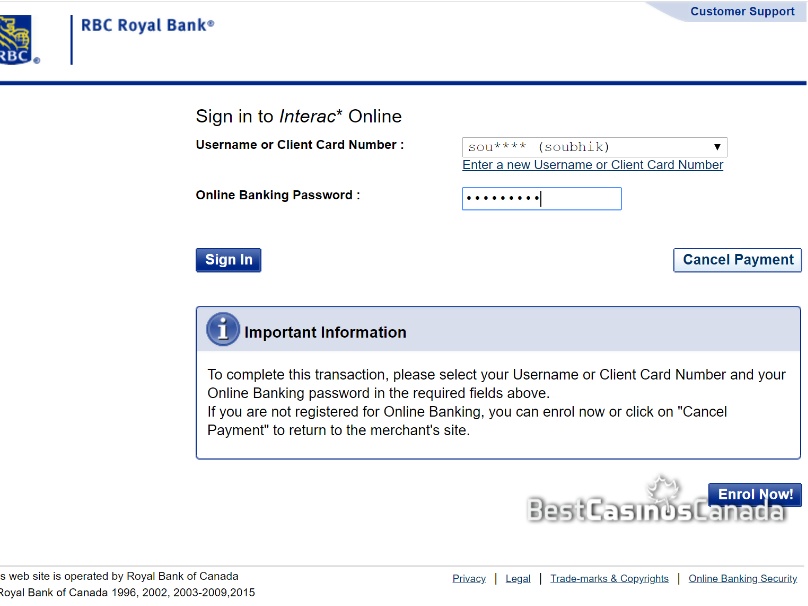

For this example, we’re going to select RBC Royal Bank.

You will be then transferred to your corresponding bank’s website to process the transaction:

Confirm the amount you want to deposit from your bank account:

You will then receive a receipt for the transaction:

Your casino account is then instantly funded! No fees were applied and we can see the full amount in our account:

Now let’s have a look at what it’s like using Interac e-Transfer instead.

Interac e-Transfer Guide

Step 1 – Select Interac e-Transfer

Go to the deposit section and select Interac e-Transfer and input the amount you want to transfer:

Confirm the amount on the following screen:

Step 2 – Select Your Banking Institution

Select your corresponding financial institution/credit union to deposit funds from. You’ll notice that there are shortcuts at the top for the well-known banks but just below it, you’ll see a comprehensive list of financial institutions/credit unions you can choose from. Unlike Interac Online, all of these options are viable which is the main advantage Interac e-Transfer has over Interac Online

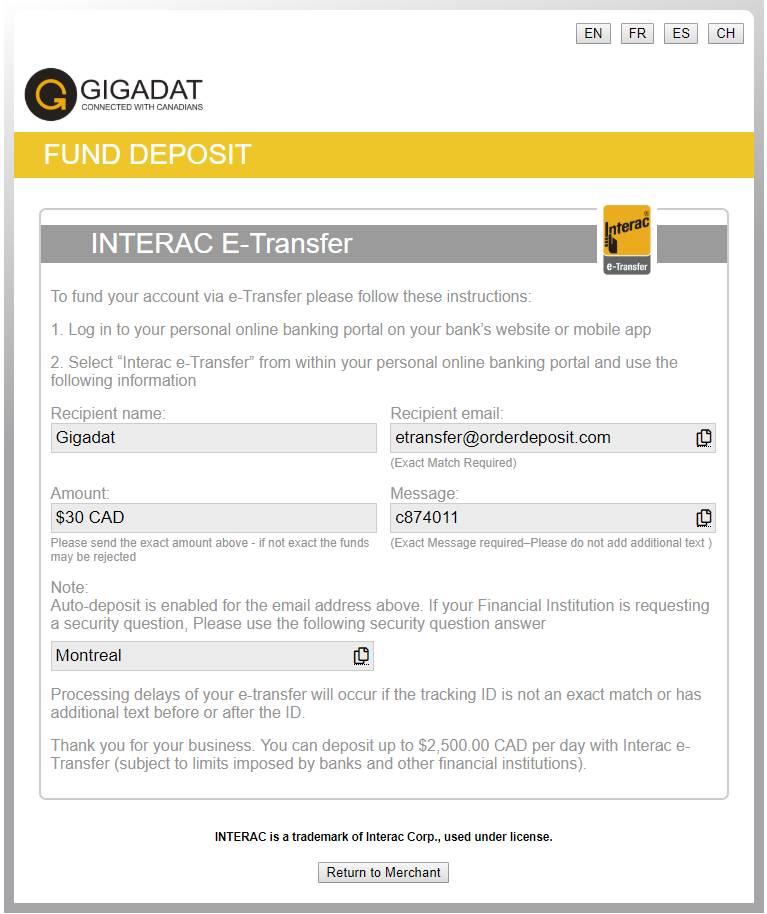

Step 3 – Follow the deposit guidelines provided

After selecting your financial institution/credit union, you’ll be shown the following email address and security question/answer:

Fill out the above details in your corresponding bank and you’ll then notice that your account is now funded instantly!

Withdrawing funds

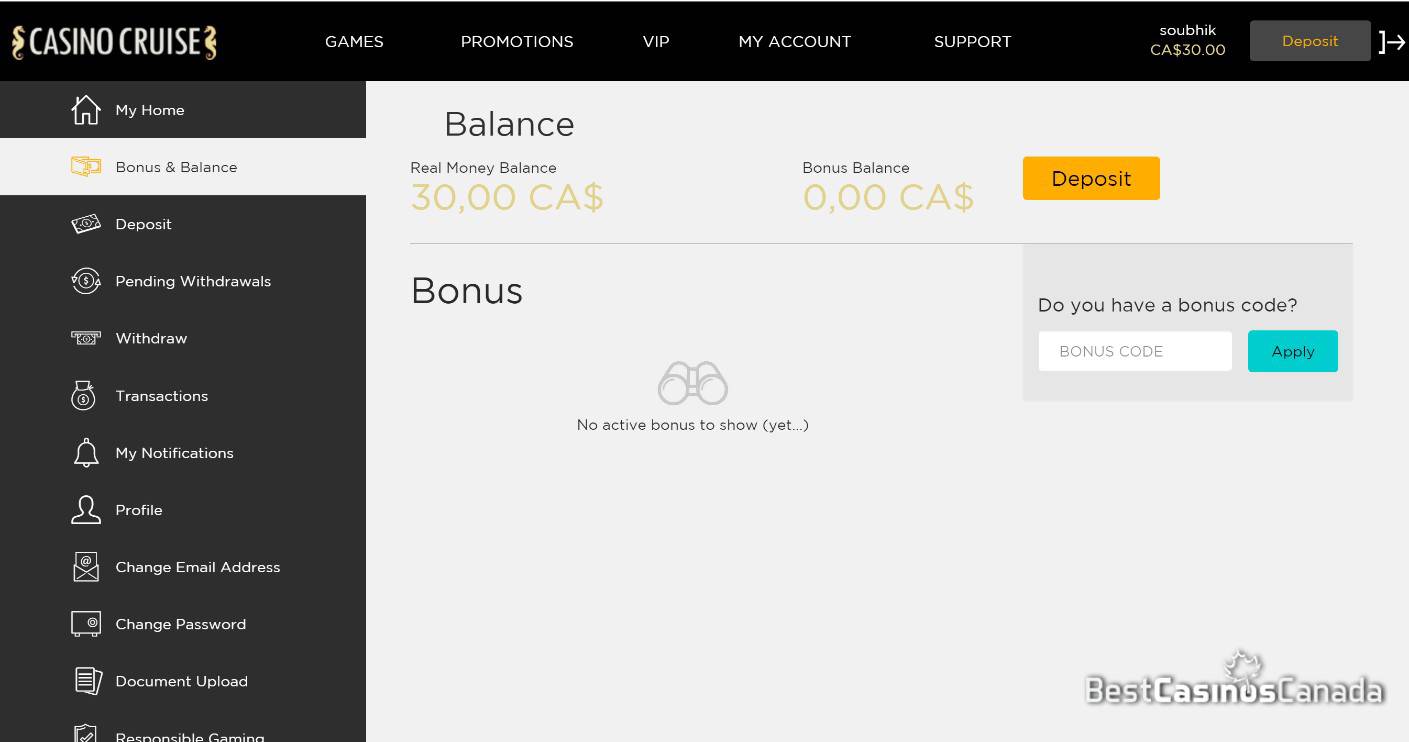

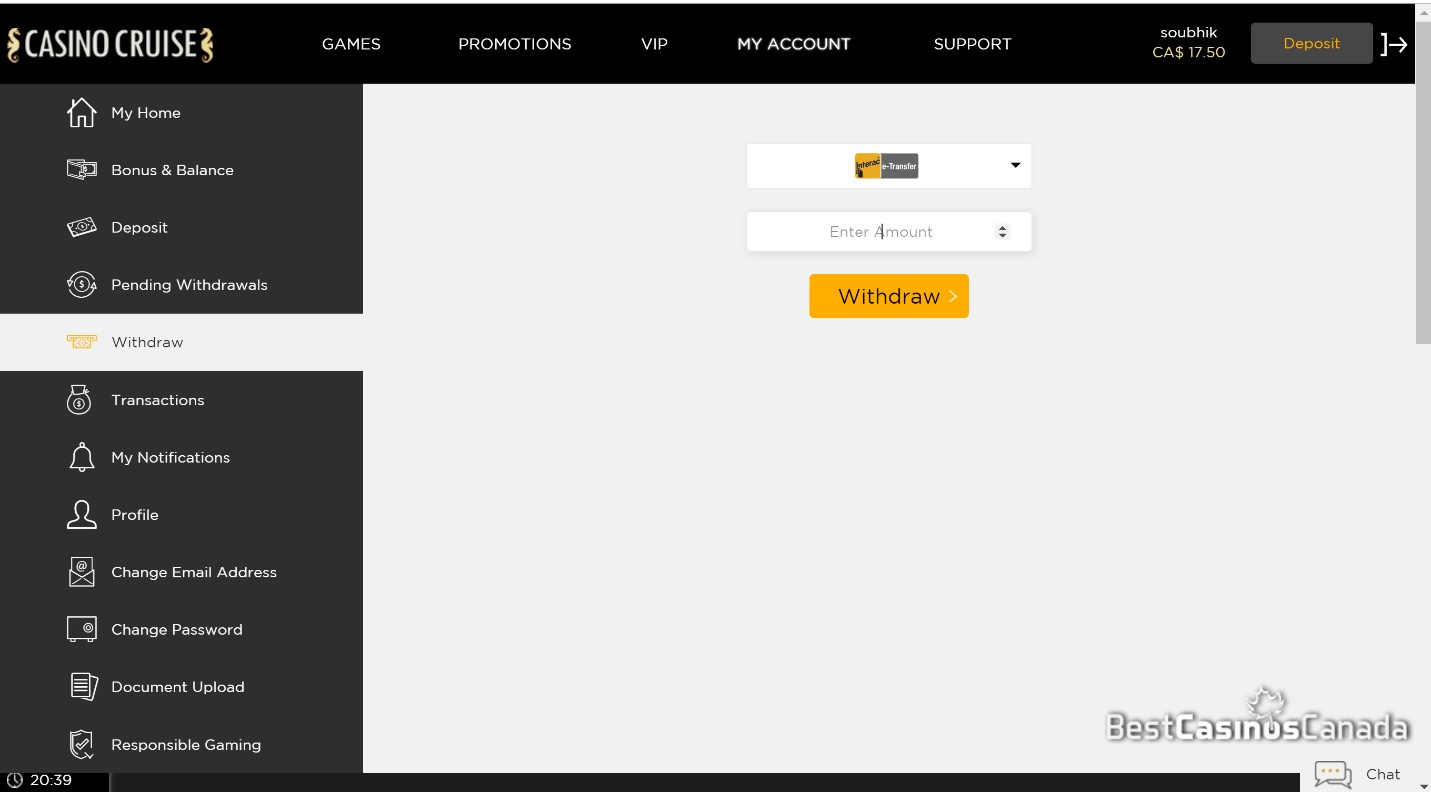

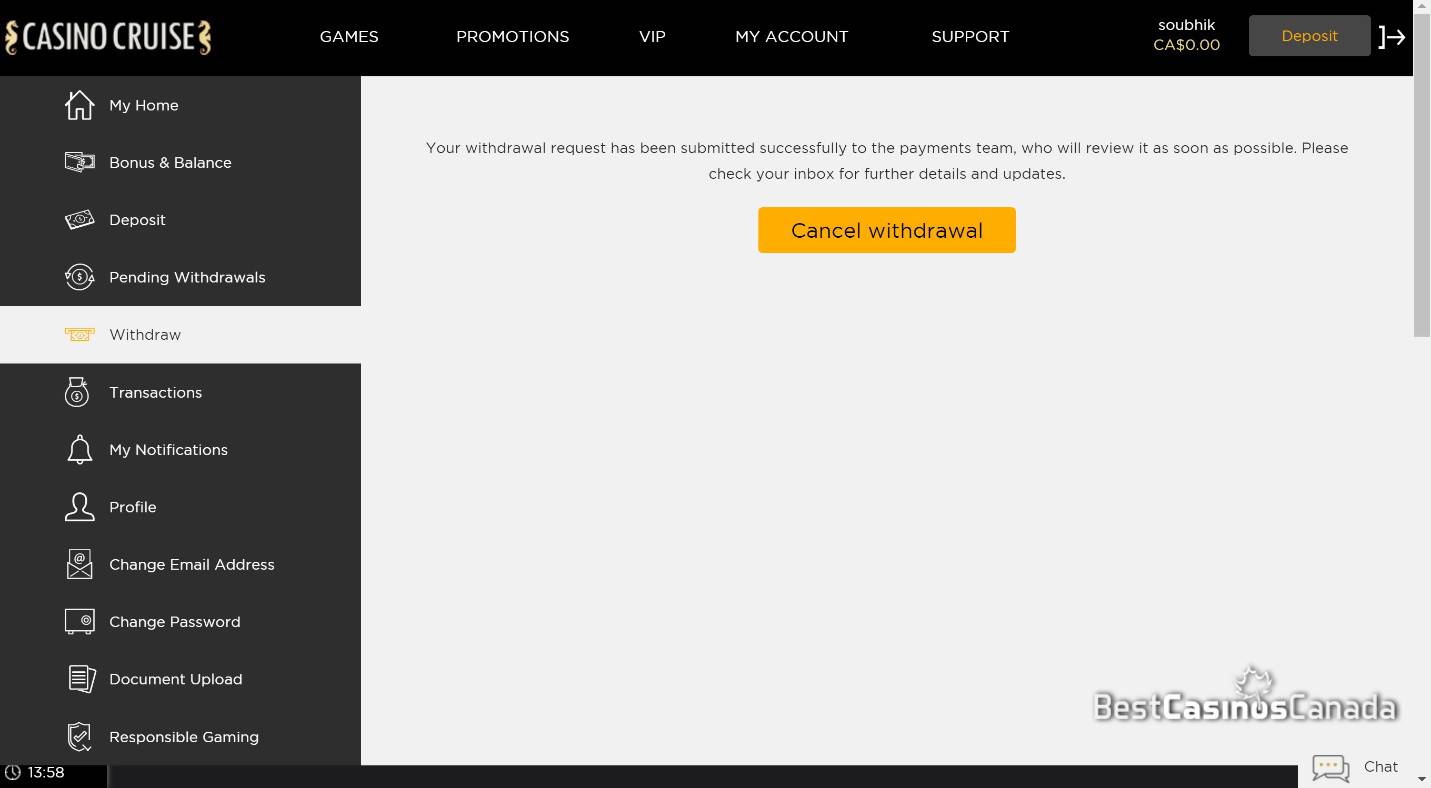

Withdrawing is as simple as going into the “My Account” section and clicking on “Withdraw”

Note: If it is your very first time withdrawing from the casino, sometimes they may ask you for proof of identity before processing the transaction. In this instance, Casino Cruise did ask us to verify 3 items which were:

– Proof of Identity

– Proof of Address

– Proof of Payment Method

During this period, the withdrawal request is put on hold until those items are verified:

Once this process is complete, transactions to and from the casino are pretty much instant.

How the funds are processed

Merchants may have a choice of processors when executing an Interac e-transfer. One company that handles the transactions is Gigadat. The company provides online merchants with a variety of payment solutions.

Due to some players developing a case of buyer’s remorse after losing, or simply planning to defraud the merchant, online gambling is considered high risk in the payments business. Merchants and banks need an intermediary system that minimizes the risk of chargebacks.

Gigadat does just that through their Interac processing service for pay-ins and payouts. Since players cannot reverse a transaction after it is deposited by the merchant, the rate of successful transactions is near 100%.

The services Gigadat offers Canadian online casinos include a deposit solution as well as bank withdrawals via email authentication and direct bank transfers.

These transactions should appear to the bank simply as “Gigadat” and not show the source of the funds on the first pass. This allows cashouts to some banks that most often reject any suspected gambling transaction.

New Interac Casinos

We have written previously about the benefits and advantages of playing at a new online casino previously. Here is a list of newly established online casinos that also accept Interac:

Bottom Line on Interac Casinos

Interac e-Transfers is a Canada-only deposit and withdrawal method that is widely popular, being offered at over 250 financial institutions including any of the big 5 banks in Canada.

The transfers will only show on your bank statement as Interac, not casino deposits, and your security is always assured.

It is one of the fastest methods for deposits available.

FAQ

Yes. For a list of sports betting sites that accept Interac, visit our resource here.

Interac Flash is a contactless debit card solution that can be used when making purchases at a merchant checkout and can also be used on NFC enabled mobile devices. It is not used for playing at online casinos.

No. Interac e-Transfers are transfers made by providing an email address whereas Interac Online are transfers made through a payment gateway. See above.

While Interac e-Transfer is widely available at most financial institutions, Interac Online is usually only available to a select few. For example, in our step by step guide we demonstrate using Interac Online at Casino Cruise which only accepts transactions from RBC Royal Bank, First Nations Bank of Canada, TD Canada Trust and a select few credit unions.

It’s extremely fast and is processed in real time up to 30 minutes.

Interac e-Transfer is widely available at most financial institutions with a list of over 250 available which can be seen here on their official website. All of the major banks offer it as well with RBC even having a dedicated page about it on their website.

No. Interac e-Transfer is only available to those who are customers of a Canadian financial institution.

I did 2 etransfers a week ago yesterday and they said I timed out but i never got my money back in my account yet…why…i used premiere pay….

The same thing has happened to me twice in May 2022 with Lucky Creek Casino. Their [email protected] has not even answered my email asking for a refund!